FAFSA •

How to fill out the FAFSA as an independent student

Your FAFSA dependency status helps determine how much financial aid you receive. But how do you determine if you’re an independent student?

Financial aid is increasingly important for students as the costs of college soar.

The most recent data shows that over 86% of college students benefit from some sort of financial aid.

The gateway to federal financial aid is the Free Application for Federal Student Aid (FAFSA). Any student who wants financial aid must fill out this form every year—and it’s the main way to qualify for grants, student loans, work study, and more.

One of the biggest factors influencing how much financial aid you get is whether you’re an independent student or a dependent student. Which one you’re classified as has to do with your age, your marital status, and about 8 other factors that we’ll walk you through below.

This guide covers what makes a student independent, as opposed to dependent. It also provides detailed instructions on how to file the FAFSA as an independent student.

What is an independent student?

An independent student is a student who meets certain requirements to receive federal financial aid based solely on the student’s ability to pay for school.

If you’re an independent student, whether a parent or guardian can afford to pay for you to go to school won’t be considered—only whether you can afford it.

The “independent student” status matters for financial aid purposes, and determining your status is part of filling out your FAFSA.

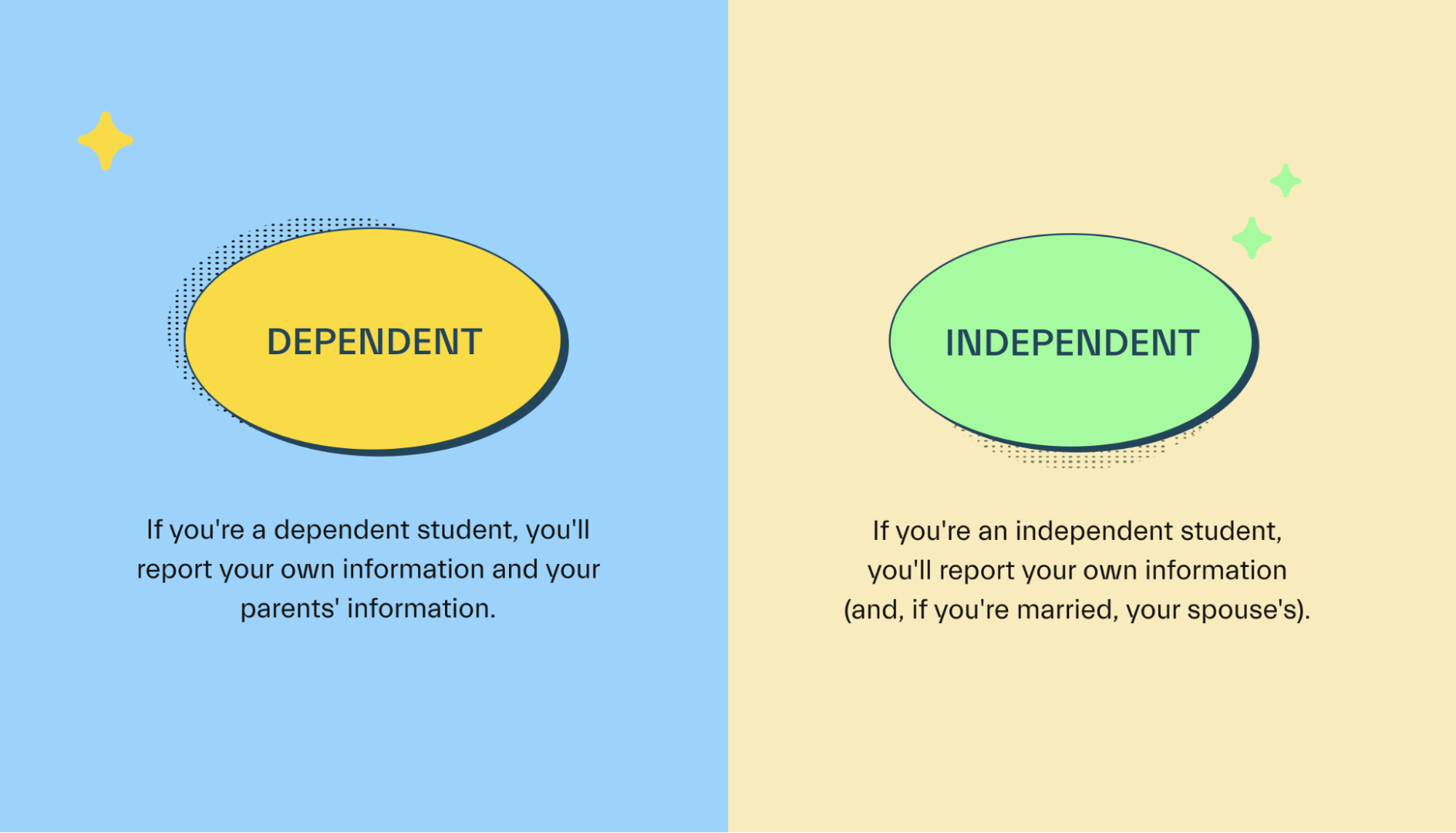

Independent students will use only their own information while filing the FAFSA.

Dependent students will use their information and their parents’ information while filing the FAFSA.

As far as financial aid is concerned, independent students are completely separate from their parents. It’s assumed that an independent student will receive no financial support from their families.

On the other hand, a dependent student is assumed to have financial support from their families—whether or not they actually do receive any monetary support.

Keep in mind, your dependency status doesn’t look at the amount of money you actually receive from your parents. Instead, it looks at what the government expects you to receive from your parents.

We’ll go over everything you need to know about FAFSA dependency status in the guide below. But if you want personalized, 1-on-1 help from a qualified financial aid advisor, consider joining Mos today. Mos members can get a personalized financial aid plan, help filling out the FAFSA, essay editing, scholarship advice, and so much more.

Requirements to be an independent student

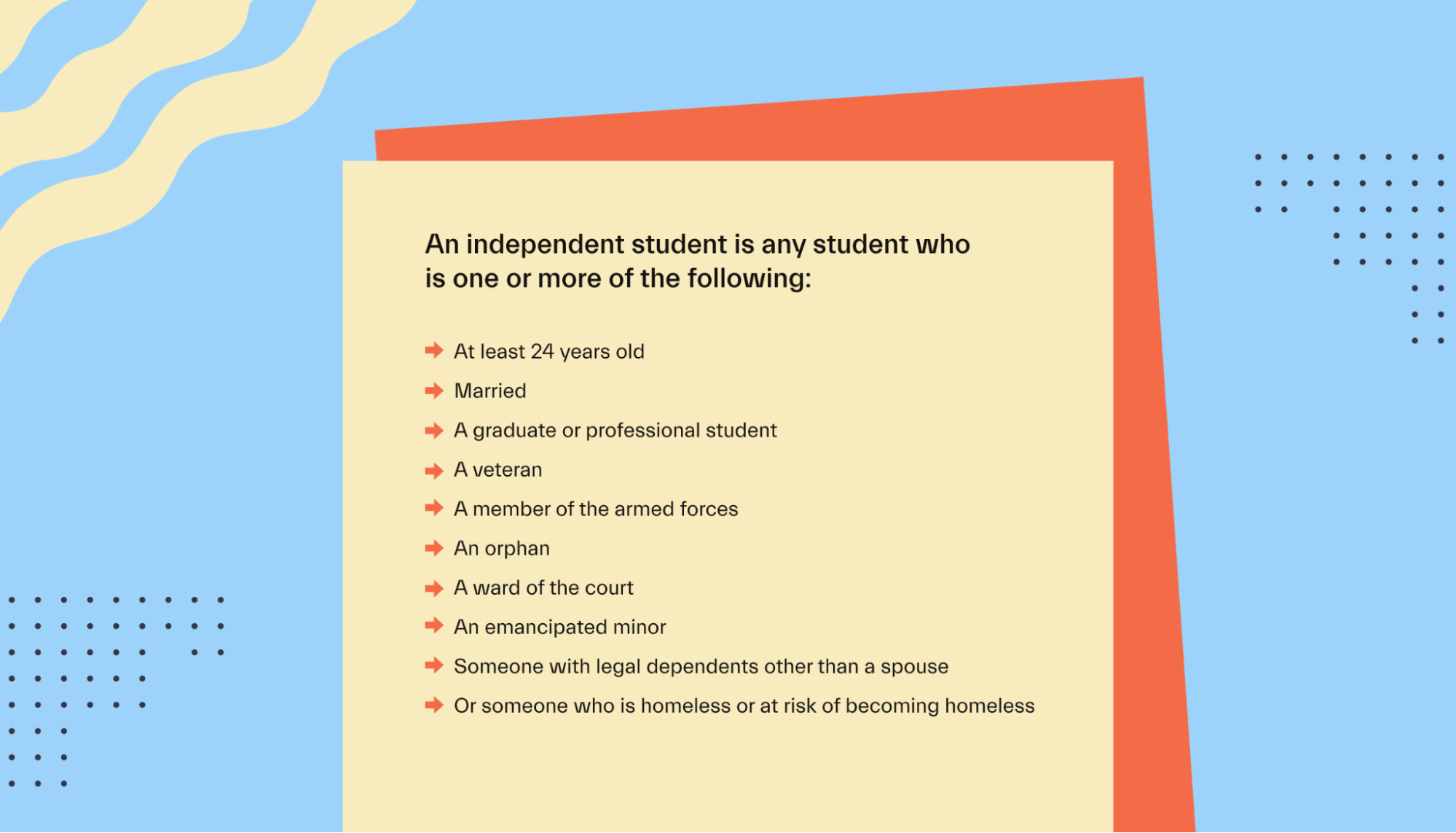

An independent student is any student who’s one or more of the following:

At least 24 years old as of January 1 of the current calendar year

Married

A graduate or professional student

A veteran

A member of the armed forces

An orphan

A ward of the court

An emancipated minor

Someone with legal dependents other than a spouse

Someone who’s homeless or at risk of becoming homeless

A student only needs to check one of those boxes to be considered independent. For example, a 19-year old student who’s married would be considered independent, even though they are under age 24. They would still be independent even if they still live with their parents—more on this below.

FAFSA Dependency Status explained

Your dependency status will either be “dependent” or “independent”. See the list above for details on what qualifies a student as independent, or use this checklist for the 2022–2023 school year.

Let’s recap: Dependency status is used to fill out the Free Application for Federal Student Aid (FAFSA).

This application is your ticket to all the different types of federal student aid, including student loans, grants, work-study, and certain scholarships.

And your dependency status is one significant factor that will determine how much aid you receive. It’s not the only factor, but it’s an important one.

FAFSA dependency status is used to predict how much financial support a student is expected to have from their parents.

Importantly, it has nothing to do with how much financial support a student actually receives. Instead, it’s a way to consider each FAFSA applicant in a consistent manner.

If you’re considered a dependent student, the government assumes that you have some financial support from your parents. As such, they use your parents’ income information to calculate your financial aid award.

If you’re considered an independent student, the government assumes that you have zero financial support from your parents. In this case, they use only your own income information to calculate your financial aid.

What if you aren’t in contact with your parents?

If you don’t have the means to contact your parents, but you’re still considered dependent, you may need to follow special circumstances protocol.

In general, this means filing the FAFSA as best you can and then contacting your school’s financial aid office for next steps.

Dependency status overrides

In some very specific situations, it may be possible to override dependency status by talking to a financial aid administrator at your school.

However, dependency overrides are uncommon—only around 0.5% of students are independent due to a dependency override.

Unfortunately, if your parents refuse to support that doesn't mean you qualify for a dependency override.

Even if you live on your own and receive zero financial support from your family, you likely won’t be able to override your dependency status (in most cases).

Instead, dependency overrides are usually reserved for more extreme situations, including:

An abusive family environment

Incarceration of both parents

Parents unable to be located

Total abandonment by parents

Overrides are determined by individual financial aid officers at schools, rather than on the federal level. Each school may have a slightly different process for these special circumstances.

If you believe you may qualify for a dependency override, you’ll need to speak with your school’s financial aid office. Fill out the FAFSA first, then follow up with your school.

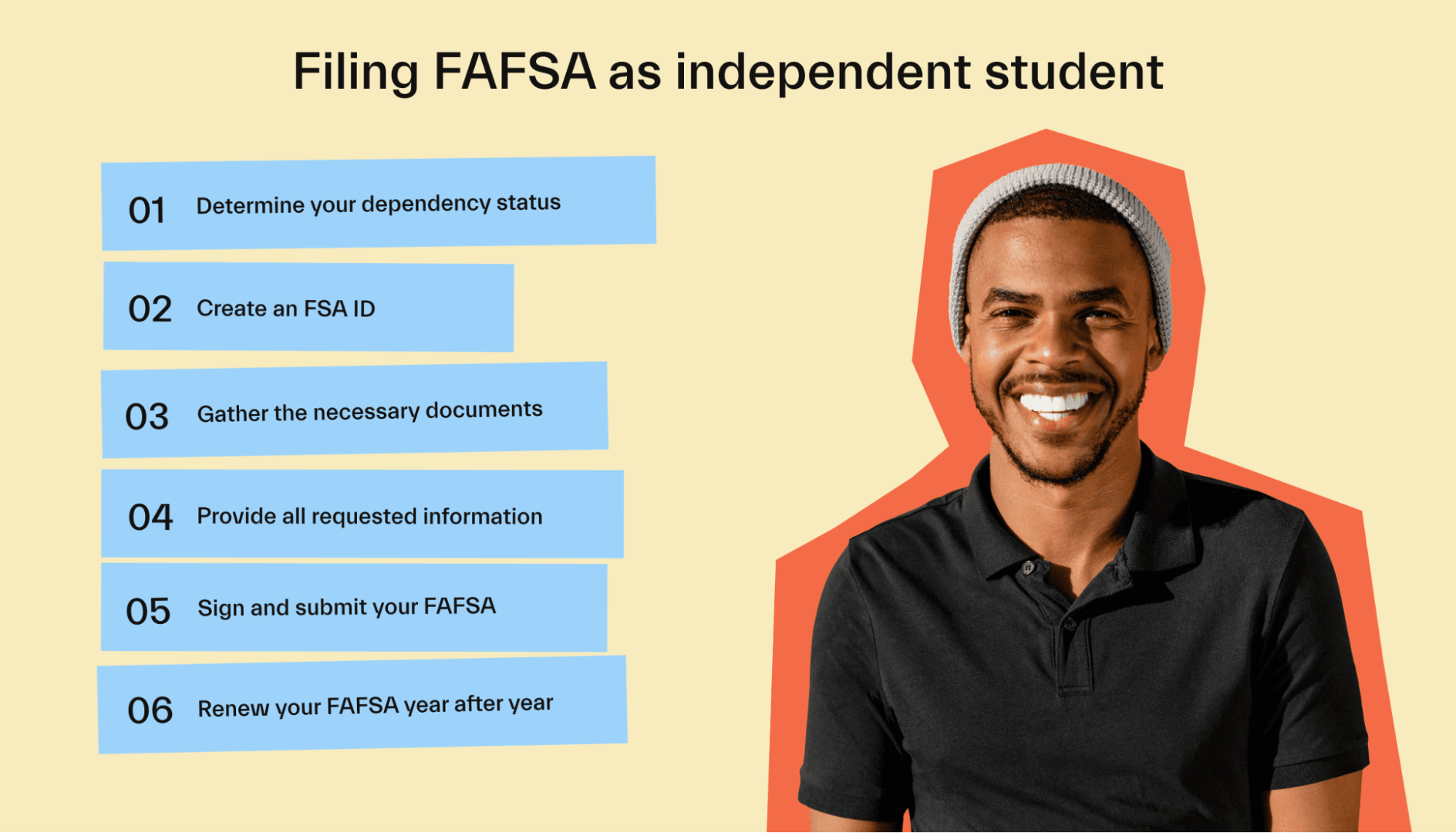

How to file the FAFSA as an independent student

Filing the FAFSA is the only way to apply for federal financial aid. As an independent student, here’s how to proceed with your application.

If you’d rather have 1-on-1 help with the FAFSA and all things student finance, connect with a Mos financial aid advisor today.

1. Determine dependency status

Before getting started, use the information in the guide above to determine your dependency status. The process is a bit different for independent students, compared to dependent students.

The steps below assume that you’re an independent student for financial aid purposes.

2. Create a Federal Student Aid ID (FSA ID)

A Federal Student Aid ID, or FSA ID, is a numeric ID number that you’ll use to access the FAFSA application and update the application later.

You can create an FSA ID during the FAFSA application process. However, the Department of Education recommends that students create an ID before beginning their application.

See this guide for how to create an FSA ID.

3. Start the FAFSA application

Next, start your FAFSA application online or through the myStudentAid app. There’s also an option to file a physical paper copy of the FAFSA, but processing times will be slower with paper forms.

You don’t have to finish your FAFSA in one sitting—it’s possible to save your progress and come back to it later. With that said, filing the FAFSA takes less than 1 hour for most students.

4. Fill out your personal information

The FAFSA will ask students for all sorts of personal information. Beyond the basics like name, date of birth, and social security number, you’ll also be asked for detailed financial information.

Some of the information you can expect to be asked for includes:

Your driver’s license number

Your federal tax return information

Records of your untaxed income, such as interest income or child support payments

Information on your assets (cash, savings accounts, investments, etc.)

As an independent student, you don’t need to submit any of your parents’ information on your FAFSA.

5. List the schools you plan to apply to

If you’re not sure which school(s) you may apply to, that’s okay. List the ones you do know. You can always come back and add schools to your FAFSA after the application has been submitted.

6. Answer dependency status questions

If the answers provided confirm that you’re an independent student, you can move on to entering your personal financial information.

If the answers confirm you’re dependent, then you’ll need to enter in your parents’ information as well. Dependent students will also need one of their parents to create an FSA ID (see step #1 above).

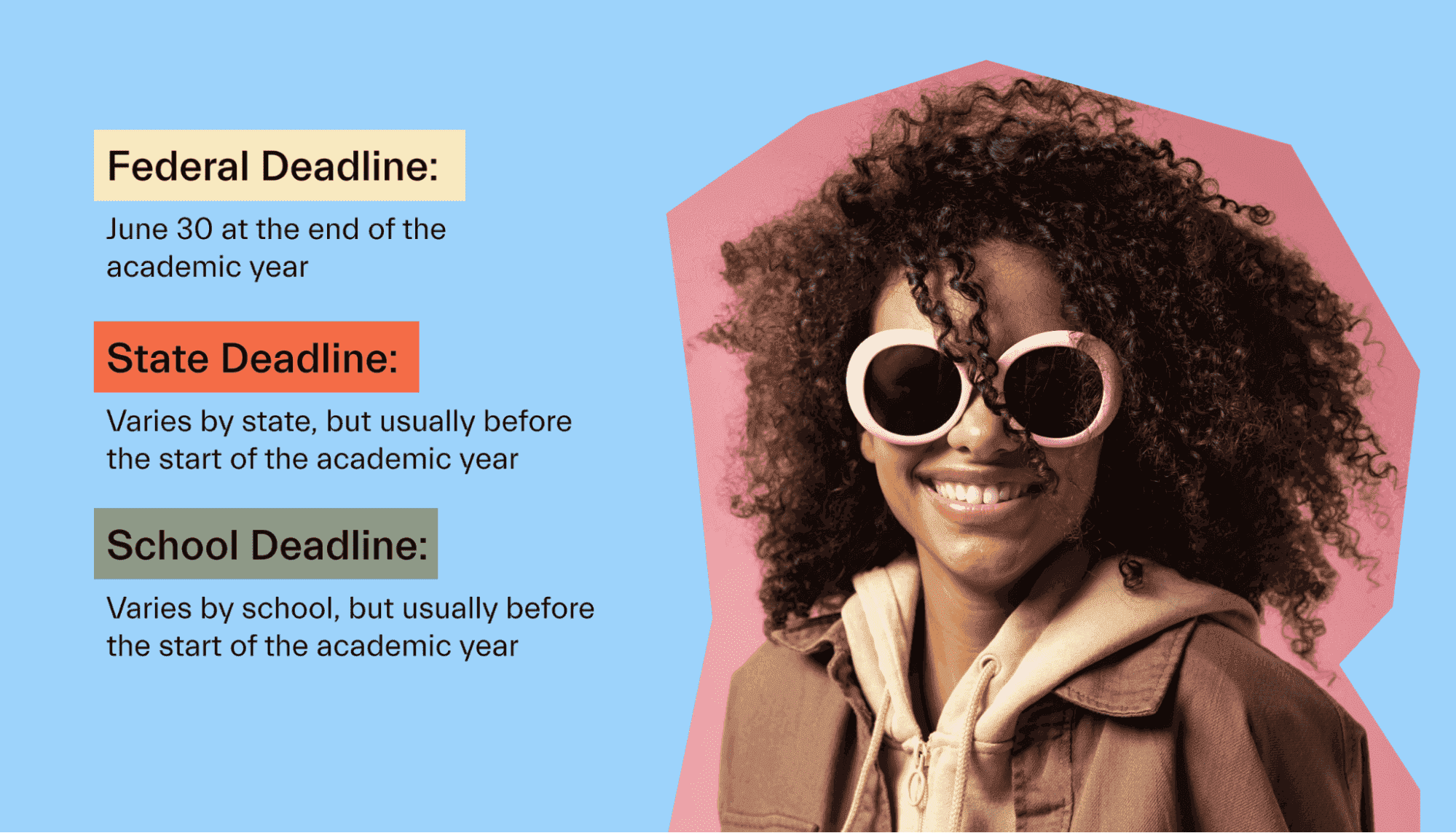

7. Sign and submit the FAFSA before the deadline

When the application is finished, you can sign it digitally using your FSA ID. There’s also an option to add a physical signature.

The FAFSA is due by June 30 each year, for the previous academic year.

So for the 2022–2023 academic year, the FAFSA is due by June 30, 2023.

However, it’s recommended to complete the FAFSA much earlier than this. Many states and individual schools have earlier deadlines—the earlier you get your application in, the better odds you have of qualifying for certain types of aid.

Even for federal financial aid, earlier applications may have better chances of receiving more aid. Certain funding sources are first-come-first-served, so it pays to complete your FAFSA early!

Applications open up on October 1, so students can complete the FAFSA any time between October 1 and June 30. FAFSA processing time generally takes 3 to 5 days for online applications.

8. Complete the FAFSA every year

Finally, remember that you’ll need to update your FAFSA every year.

Financial aid eligibility is recalculated each year. To qualify for federal aid, you must submit the FAFSA each and every academic year.

Do independent students get more financial aid?

Independent students often receive more financial aid than dependent students—but this isn’t always the case.

Federal aid awards are based on a variety of factors. Expected family contribution is a big one for dependent students. If you’re dependent and your parents have high salaries, you’re unlikely to qualify for as much aid.

On the other hand, an independent student who themselves has a high income level may actually qualify for less aid than a low-income dependent student might.

Financial aid calculations involve many factors. The only way to find out how much aid you may qualify for is to file the FAFSA and wait for your financial aid award letter.

Conclusion

Your FAFSA dependency status influences what types of financial aid you qualify for, as well as the size of your award.

All students—both independent and dependent—should remember to submit the FAFSA. Financial aid awards are per year, so don’t forget to update your application each academic year!

If you want to maximize your financial aid dollars as an independent student, a Mos advisor might be your new BFF. Mos members can get personalized financial aid advice, essay editing, tuition negotiation, and much more. Find the best plan for you to get started.

Let's get

your money

- Get paired with a financial aid expert

- Get more money for school

- Get more time to do you